No matter what approach is used, a forecast stands or falls based on its underlying assumptions. Firstly, it could be worth it to spend some time creating different versions (called scenarios) of your financial model. Entrepreneurs tend to be optimistic people, which is a good characteristic to have to keep up the energy and push through where others might quit. As you might have noticed already, some of the elements mentioned above include some tweaking of the numbers before you get to the right information that is presented in the financial statements.

Step 4: Finalize Projections

Many entrepreneurs find themselves at a loss when it comes to creating an accurate financial forecast. But if you don’t grasp the ropes of forecasting your finances effectively, scaling up might remain just a dream. Having a financial model can help in the fundraising http://www.nativechildalliance.org/partnerships.htm process, as external financers typically require you to provide a forecast. This makes sense, considering the fact you are asking them to put their money in your company. Based on the value of an asset and its useful lifetime depreciation is calculated.

Download Our Free Financial Model Template

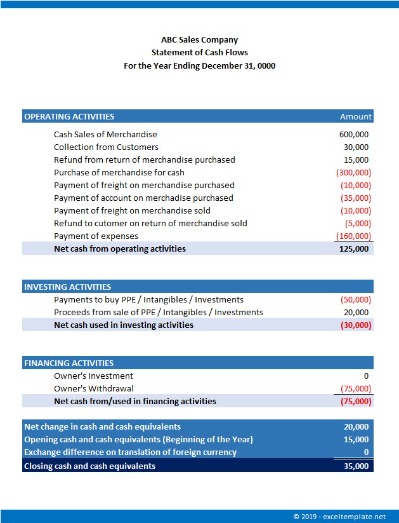

List your expected income and expenses over a specific period, calculate net income and consider factors like growth possibilities or cost reductions. A cash flow statement is a document that shows how much money is coming in and going out of a startup. It helps http://www.pustoty.net/showthread.php?p=379531 the startup know when it might have too much or too little money. By regularly reviewing and updating expense forecasts, startups make informed decisions about cost-cutting measures, investments and budget adjustments, reducing the risk of overspending.

Why is a startup business plan necessary?

But a common mistake is to focus only on these past numbers without looking carefully at how these might change in the coming period and properly accounting for new business strategy and bets the company is making. When doing this manually, there is http://artsportal.ru/picture/11457 a significant amount of work and time that goes into building a forecast that is realistic. FP&A modeling using a tool like Mosaic makes this process substantially faster and more accurate and allows for multiple scenarios to be built and reviewed.

Step Two: Expenses Projection

This way, you can complete and secure your short term objectives very well. And your long-term targets will show the desired market part and the ambition investors are searching for. The top-down approach’s pitfall is that it might seduce you to forecast too optimistically, especially sales estimation. Therefore, it will be best to complement the top-down model with the bottom-up approach.

- By creating a detailed projection that accounts for all possible risks and rewards, you can show potential investors that your startup is worth their time and money.

- The Finmark Blog is here to educate founders on key financial metrics, startup best practices, and everything else to give you the confidence to drive your business forward.

- Financial projections can help forecast business growth, determine if and when you’ll make a profit, and help your startup establish benchmarks for meeting any predetermined goals.

- At the core of every startup, financial projections act like a heartbeat, reflecting the vital signs of your business.

- Available with or without sample text, this template lets you anticipate financial challenges and opportunities in the medium term, aiding in strategic decision-making and ensuring sustained business growth.